In the past 12 months, the Australian dollar has been sent lower against US dollar, New Zealand dollar and the British pound. The exchange rate is also slightly down against the Japan yen and Euro. It's largely because of two large influences over the Australia dollar - interest rates and commodity prices.

The strength or weakness of the Australian dollar exchange rate is also impacted by the value of the other currency. For example, if the US dollar gets stronger in its own right, then all other things being equal, the Australian dollar will weaken and the AUD to USD exchange rate will fall.

Interest rates

Interest rates are one of the main reasons that the Australian dollar is so low. Right now, the Reserve Bank of Australia (RBA) has set the official cash interest rate at 0.1%. They have been this low for a year. The RBA cut interest rates when the pandemic hit back in March 2020 and then again in November of the same year.

The central bank has also committed to keeping interest rates this low until 2024. Contrast this to other countries like the UK and Norway where official interest rates are already on the rise.

If interest rates are low and staying low in Australia, but rising overseas, it pressures the Australian dollar lower. This is because investors looking for a return will take their money out of Australian dollar assets and move them to other countries with higher interest rates.

So why are interest rates heading up overseas? Most of it comes down to inflation.

Inflation concerns

Inflation across the world have a huge impact on interest rates which, in turn, changes the value of each currency and exchange rate.

So what's happening with inflation?

Well it's on the rise.

As economies around the world have opened back up from COVID induced lockdowns, a few problems are appearing. Firstly, there appears to be a global shortage of many goods and services. Everything from computer chips to space on container ships is suddenly in higher demand and shorter supply. The result is that prices increase.

Inflation changes interest rates because central banks aim for only moderate inflation. If inflation gets too high, then central banks tend to increase interest rates to cool prices down again.

Inflation in Australia so far has been kept in check. The latest figures from the ABS showed that inflation in Australia in the last quarter between March and June increased by 0.8%. Prices were 3.8% higher than a year before when the country was in the early stages of the first national lockdown.

Most economists including those at the CBA, expect inflation to rise from here. Australia may have avoided many of the health impacts of the pandemic but because the country was relatively slow to reopen, the inflationary forces have been delayed.

Commodity prices

Commodity prices have a big say on the direction of the Australian dollar. Both the AUD and commodity prices tend to rise and fall at the same time. This is because such a massive portion of the Australian economy comes from mining and exporting commodities. That's why it's commonly called a 'commodity currency.'

Early on in 2021 when iron ore and coal prices motored higher on the back of high Chinese demand and lower commodity supplies, the Australian dollar got stronger against many major currencies.

In the second half of 2021, the opposite has happened. Commodity prices have fallen from their meteoric highs and the Aussie dollar has fallen too.

The Aussie dollar is not expected to stay so low

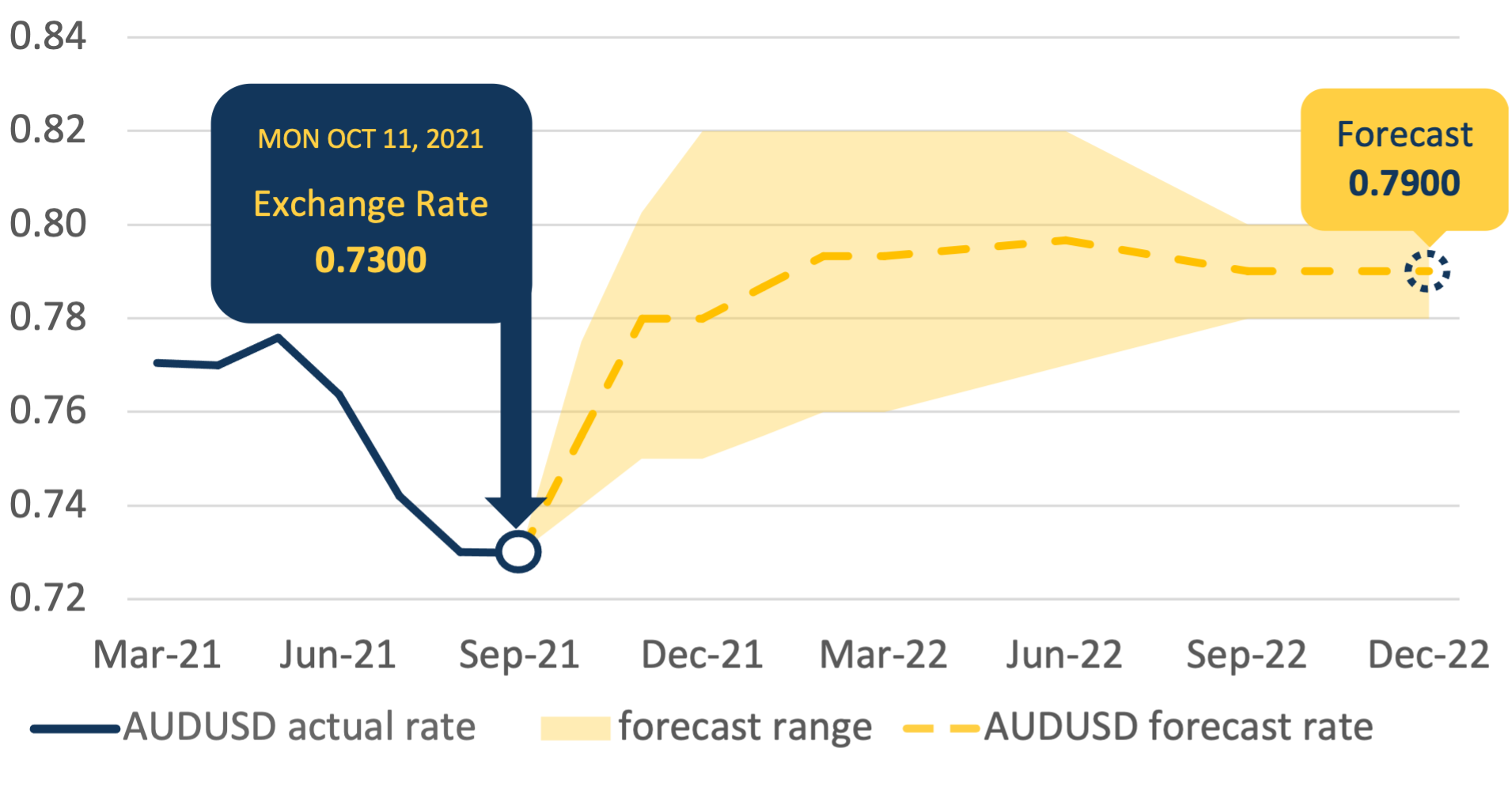

While the AUD to USD exchange rate has fallen, it is forecasted to move higher in 2022. The 'Big 4" major Australian banks have lowered their AUD to USD forecasts by 5% in 2022, but they still expect exchange rates to range between 75 and 80 US cents.

It's a similar story with the AUD to NZD exchange rate. It has fallen more than 4% since the middle of the year but is predicted to edge up next year. Top banks in Australia and New Zealand have a less pessimistic outlook for the Aussie (AUD) compared to the Kiwi (NZD) - reflected in their AUDNZD exchange rate forecasts in 2022. Generally, their outlook for the NZD is more negative compared to the AUD.