There are many different influences over the local currency, increasing commodity prices appear to be the key driver of the recent rise of the Australian dollar. Prices of commodities like oil, wheat and nickel have soared recently on the back of the war in Europe. This has increased the demand for 'commodity' currencies like the Aussie dollar, helping it move higher against most major currencies including the US dollar, Euro and British pound.

According to the Reserve Bank Australia

There has been a close relationship between the terms of trade and the value of the Australian dollar over a long period of time. The terms of trade measures the ratio of export prices to import prices. In general, an increase in the terms of trade is associated with an appreciation of the Australian dollar, while a decline in the terms of trade is associated with a depreciation of the Australian dollar.

Commodity prices have a large influence on the terms of trade (commodities are goods such as iron ore, natural gas and agricultural products). This is because commodities account for a large share of Australia's exports and so movements in commodity prices result in movements in export prices.

Why the Australian dollar is getting stronger

The Australian dollar is getting stronger largely thanks to rising commodity prices like nickel, coal, gas and wheat. This is despite the US dollar also gaining strength as investors buy up so called 'safe haven' assets and currencies.

Commodity prices are one driver of the Australian dollar along with its interest rate differential, risk appetite and the performance of other currencies. Let's have a look at the recent performance of the AUD against other major currencies.

The AUD to USD exchange rate

This week, the AUD/USD hit a 4 month high above 74 cents coming as a surprise to many market experts. The US dollar has also managed to strengthen against most major currencies since the last 2022 however the Australian dollar has outperformed it suggesting the move in commodity prices is the dominant market influence.

The AUD to EUR exchange rate

This uncertainly has also sent the Euro sharply lower. The AUD to EUR exchange rate has risen to its highest level in over 4 years. This means that it is now one of the best times to buy Euros with Australian Dollars in 2022.

The AUD to GBP exchange rate

The AUD to GBP has also move up significantly along with the Euro. It rallied more than 6% in the last fortnight to rise above 0.5600 for the first time since April 2020.

The Forecast for the Australian dollar in 2022

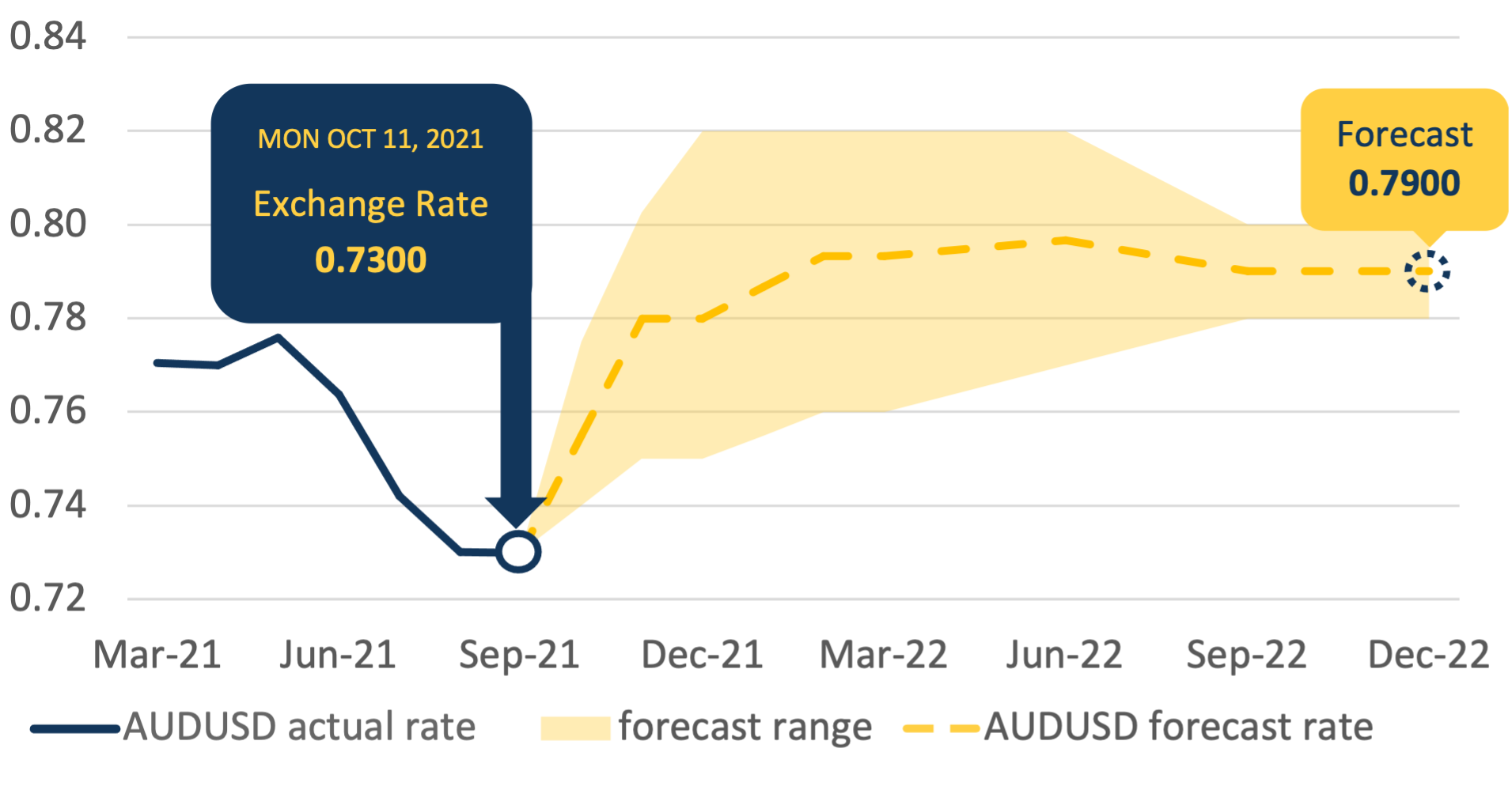

Since June 2021 the Australian dollar has been falling against the US dollar. For the rest of 2021 many economists are expecting a minor rebound to 80 cents, before trending sideways in the new year.

Many economists have lowered their Australian dollar (AUD) forecasts for 2022 to remain between 75 and 80 cents by June, but also expect the bumpy ride to continue.